Check out our new platform: https://thecapital.io/

Ever since its first implementations, global stock markets have provided the mainstream media with stereotypes of a fast-paced environment, where money comes and goes at a staggering pace as investors squeeze in their orders amongst hundreds of available options. Until fairly recently, the common image of a stock exchange was wall street brokers running around the halls, screaming orders from the top of their lungs, as the boards changed values at an inhuman rate. That certainly was the norm for a long time, before online trading took over. But stock markets, much like most businesses, have an open and close schedule which would limit the time available to trade. It was under that premise that OTC first came to fruition.

Over-the-counter (OTC) trading offers options outside of centralised exchanges and traditional trading hours. They do not have physical locations and are conducted by voice or electronically between two parties, offering investors discretion and access to liquidity outside the ordinary market. OTC trading can also remove bureaucratic layers that can hinder larger deals.

OTC trading executes a significant chunk compared to overall on-exchange volumes. According to a Reuters report, OTC trading represented only 16% of the entire stock market in 2008. Six years later, that number went up to 40%. As of late 2019, the dollar trading volume for OTC assets had reached 329 billion US dollars. A similar, yet much higher, level of growth also applies to the market in digital assets, as we’ll cover later in this piece.

The advantages of buying stocks outside of a centralised platform are quite straightforward; fast accessibility, fewer bureaucratic obstacles, and the ability to trade foreign stocks within the local market hours, and with lower market impact. But those strengths originate from the conventional stock market. When it comes to OTC trading for digital assets, the benefits and influence over the market are far, far greater.

Here we’ll have a look at the importance and power behind OTC trading for digital currencies; its history, the benefits, memorable cases, and most importantly, why it is essential for the realm of cryptocurrencies. What we will establish about crypto OTC trading here will also serve as a basis for understanding how Zerocap’s OTC desk operates; through a personalised service of frictionless, borderless trading with top-notch security and guaranteed liquidity.

Why OTC for Digital Assets

There are two different kinds of pools for OTC trading in the crypto market: Lit Pools and Dark Pools. Lit pools are most common, as the platform functions nearly the same as a traditional exchange, where investors are able to see the different bids and offer inside the network. Once they present an offer, it registers for other clients to see on the orderbook. Dark pools, on the other hand, are fully closed markets where information is displayed only for the two parties involved; the client and the platform. Through dark pools, there are no visible order books, providing a level of anonymity favoured for institutional investors with high trade sizing.

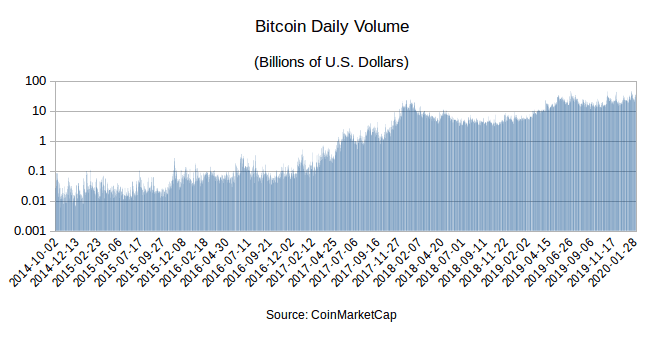

So what problems does OTC trading solve for digital assets? For starters, there is the issue of limited liquidity on retail crypto exchanges. According to a data report published by CoinMarketCap, the average daily trade volume for total cryptocurrencies circulates around US $100 billion, $72 billion of those being Bitcoin, Ethereum, and Tether (USDT) combined. For average crypto exchanges, the volume available per trade is directly related to the liquidity available on each platform. The same applies to tokenised assets linked with physical properties like Pax Gold (PAXG), (each unit being represented by one fine troy ounce). If you want to purchase large amounts of PAXG then you would typically have to access multiple exchanges to fill your order due to limited liquidity. That is where OTC trading comes in. Although digital assets have many exchanges available, their liquidity is not large enough to hold single trades with substantial transaction volume. This has been the primary impetus for non-exchange OTC firms to enter the market, solving liquidity issues, and providing larger investors, businesses, and miners opportunities to access more efficient liquidity.

OTC trading connects you directly with the counterparty or single-dealer platform, guaranteeing price and minimising transaction risk against slippage and market impact, so often seen with standard exchanges. The warranty in price, combined with less counterparty risk and instantaneous access to funds, provides the investor with a more secure, fast, and reliable method of performing larger trades. For digital assets, transactions putting down an order through a trusted OTC-based firm can be the difference between a successful trade and a substandard one.

OTC trading also provides a level of anonymity not available at centralised venues. Having large orders sitting on exchange order books, and facing counterparty risk through having to pre-margin these exchanges, presents hacking and order front-running risks. With OTC trading, the orders are truly anonymous so clients won’t find themselves revealed as significant investors.

In a nutshell, OTC trading in the crypto market has the same foundations as traditional OTC trading outside stock exchanges. But contrary to the latter, its financial relevance to the crypto market is far higher than centralised platforms. In fact, OTC orders in digital assets represent the largest and anonymous portion of the entire crypto trade volume.

OTC — The real market behind crypto

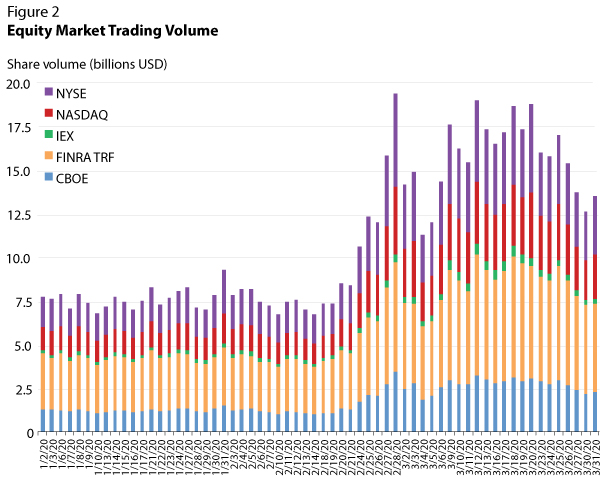

Earlier in the article, it was mentioned that traditional OTC stock markets currently take up to 52% of the daily trade volume of centralised exchanges. For digital assets, the influence of OTC trading over the crypto market is steadily increasing as it takes over the majority of trade volume from exchanges with limited liquidity. In April of 2018, Bloomberg reported that the OTC crypto market had a daily trading volume of US$15 billion. The reported volume varies, yet they all indicate an unprecedented rise in use over the past two years.

According to a 2018 report from trading research company TABB Group, the OTC crypto ecosystem is up to three times larger than the open exchange market. Since then, over-the-counter trading has grown exponentially in crypto. A 2020 report from crypto exchange Kraken affirms that the daily OTC trade volume grew by almost twenty-fold globally since early 2018, which would represent a trading volume of approximately US$ 300 billion. Compared to the current US$ 140 billion per day reported by the combined exchanges, OTC allegedly has nearly 70% of the total crypto market daily trade volume. TABB firm also backs up Kraken’s conclusion, claiming that OTC trading represents 20 out of the average 26 billion US dollars traded daily in Bitcoin, approximately 76% of the entire market.

Not only does OTC digital assets trading have a substantially larger trading volume than stock market OTC trading, but its anonymity allows high net worth investors to pursue investments in digital assets without their order being publicised unless it’s made public by themselves.

A recent example of this can be seen through the company MicroStrategy, who announced last August that 25% of all their assets are in bitcoin, close to US$ 250 million. The information was made public by MicroStrategy CEO Michael J. Saylor, who claimed the company bought exactly 21,454 bitcoins. Given the average bitcoin value of 11,600 in August, it was theorised by market journalists that the assets were acquired through a single purchase in OTC markets, instead of a gradual purchase, although we believe that is far -fetched and quite unlikely. On September 15th, it was announced that MicroStrategy invested an extra US$ 175 million in Bitcoin, upping their holdings to US$ 425 million. Regardless of the method, there was no way for the public to have access to such information unless the company decided so, which shows how OTC crypto trading maintains an air-tight trading ecosystem with discrete transactions, regardless of the amount being traded.

Digital Asset OTC trading is growing liquidity, reducing counterparty risk, and providing entry points for larger traders, investors, and institutions. We believe that this will continue, and eventually aggregate into even larger pools — in a similar maturity curve to the FX market. Our OTC investment platform provides clients with deep liquidity as they move seamlessly from fiat to digital assets, with price-lock and post-trade settlement so the trades are not only optimal, but fully discreet and secure.

https://twitter.com/thecapital_io

Over-The-Counter Trading: The Decision-Maker of Digital Currencies was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/2SkGsI5

Comments

Post a Comment

Any questions, Please.